FinaCiti is a small financial services organization that hired me to create content for their Instagram!

They wanted the content to feel professional yet inviting and authentic.

Reducing alcohol consumption is good for a lot of things, your bank account just happens to be one of them! Some estimates predict the average American adult spends between six and ten THOUSAND dollars a year on alcohol! And that doesn't even include the ubers you take when you're drinking, or the late night drunk eats you pick up, or the morning after greasy breakfast you have no energy to cook! While your alcohol habits aren't often talked about when thinking about fiscal responsibility, our alcohol habits can get expensive...fast! #smartspending #finaciti

Restricting yourself entirely isn't reasonable, and it will likely result in you throwing your budget out the window entirely. Instead set a monthly amount dedicated to those "silly" purchases. Treating yourself occasionally is important because you work hard and you deserve it! But let's reign it in and keep ourselves wanting. #impulsespending #smartspending #finaciti

It's easy to save the money you don't spend. But you should really be spending the money you don't save. Prioritize saving at the beginning of your pay cycle rather than saving what's left at the end of the month! #smartsaving #finaciti

Secure Your Legacy: Create an Estate Plan! Protect your loved ones and honor your wishes with an estate plan. It's not just about money, it's about: 1️⃣ Family Security: Ensure their well-being when you're gone. 2️⃣ Reduce Conflict: Minimize disputes among loved ones. 3️⃣ Healthcare Choices: Specify your medical preferences. 4️⃣ Tax Efficiency: Preserve more wealth for future generations. 5️⃣ Charitable Impact: Support causes dear to your heart. Craft your plan with a professional's guidance. Your legacy matters. #EstatePlanning #LegacyPreservation #SecureYourLegacy

While building your credit is super important, it's also super easy to swipe, swipe and then swipe some more! Instead use physical cash for "fun money." This will limit your spending and help you think more critically about what you should really spend those hard earned dollars on. #smartspending #finaciti

We are often sandwiched between supporting children and aging parents. While we know how important it is to support our loved ones, sometimes we have to be a little selfish (and that's okay). Make sure to prioritize your own financial well-being to secure your future and avoid potential financial strain.

Just like creating a diet for yourself, it's important to not set expectations that are too strenuous, or a plan that is not realistic. Consistency for an extended period of time is always better than intensity for a short period. Remember this the next time you create a budget for yourself!

Once we start making good money it's easy to start spending it...and fast. Instead think about your future self and sacrifice for them. Live below your means so that in 10, 20, 30 years you can live beyond them.

In today's world debt is too easy to rack up. It's also too easy to get into multi year payment plans for high-interest debt. Focus on paying off high-interest debt, such as credit card debt and student loans as quickly as possible even if it means making changes to your lifestyle. Create a debt repayment plan and allocate a portion of your income towards reducing your debt burden.

Regrets can be powerful teachers, especially when it comes to money-related choices. When you look back on your financial journey, what money-related choice do you regret the most? Share your insights below and let's find solace and wisdom in our shared experiences! #MoneyRegrets #FinancialChoices #LearningFromMistakes

We've all heard the saying "cash is king" right? While it is true that cash may not provide the same long-term growth potential as certain assets, it still holds value and plays a crucial role in financial planning. Holding some cash can be beneficial for emergencies, short-term liquidity needs, and taking advantage of investment opportunities. However, diversifying your portfolio with various assets can help you grow your wealth over time. From room for appreciation, to income generation, to inflation protection, to portfolio diversification, to leverage opportunities to tax incentives, there are so many reasons why cash really isn't always king.

Sometimes, a single mistake can carry a heavy price tag in our financial journey. When reflecting on your own path, what is the single most expensive mistake you've made? Share your experiences below and let's turn our costly lessons into valuable insights! #ExpensiveMistake #FinancialJourney #LearningFromExperience

Investing 101: The Beginner's Guide to Financial Growth! Here are five key tips for newbie investors to make the most of their journey towards wealth creation: 1️⃣ Do Your Research: Knowledge is power! Before diving in, spend time researching different investment options and understanding market trends. Make informed decisions to set a solid foundation for your investment journey. 2️⃣ Have a Plan and Stick to It: A well-crafted plan is your guiding light. Define your financial goals, risk tolerance, and time horizon. Create an investment strategy that aligns with your objectives and stay committed to it, even during market fluctuations. 3️⃣ Diversify Your Portfolio: Don't put all your eggs in one basket! Spread your investments across various asset classes, such as stocks, bonds, real estate, and more. Diversification helps minimize risk and maximize potential returns. 4️⃣ Be Patient: Rome wasn't built in a day, and neither is wealth. Stay focused on the long game and avoid the temptation of short-term gains. Remember, investing is a marathon, not a sprint. 5️⃣ Stay Disciplined: Emotions can cloud judgment. Stick to your investment plan, avoid impulsive decisions, and resist the urge to time the market. Consistency and discipline will be your key allies on this exciting financial journey. Investing opens doors to financial freedom and prosperity. Remember these tips, embrace the learning process, and watch your wealth grow steadily. Let's embark on this exciting adventure together! #Investing101 #FinancialJourney #WealthBuilding #StayDisciplined #DiversifyYourPortfolio

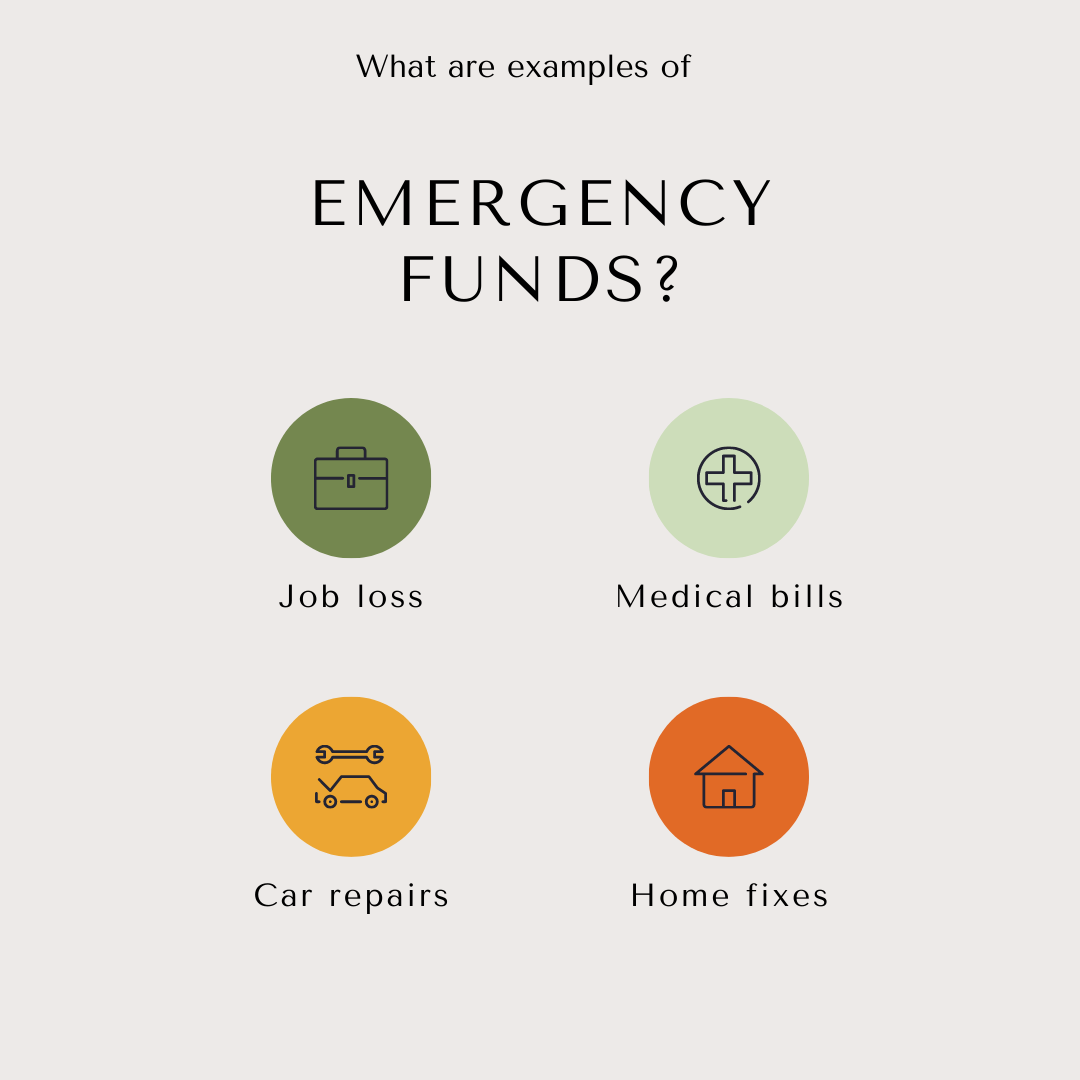

Prepare for Life's Unexpected Twists: The Power of Emergency Funds! Life throws surprises our way but having money set aside for those surprises helps break the blow. An Emergency Fund acts as a shield against the unexpected, providing peace of mind and financial security when it matters most. Start by setting aside a portion of your income each month, building your fund one step at a time. Aim for at least 3-6 months' worth of essential expenses to weather any storm that comes your way. Pro Tip: Keep your Emergency Fund separate from everyday accounts. This way, it's easily accessible when needed, yet protected from impulse spending. Take charge of your financial well-being, one step at a time. Start building your Emergency Fund today, because peace of mind is priceless! #EmergencyFund #FinancialSecurity #PrepareForTheUnexpected #PeaceOfMind

We all have moments we wish we could change, especially when it comes to our finances. Reflecting on your journey, what would you consider your most significant financial mistake? Share your stories below and let's empower each other with valuable insights! #MoneyMistakes #FinancialJourney #LearningExperience

We've all had our fair share of financial missteps, but looking back, what stands out as the most significant one in your life? Share your experiences below and let's turn our missteps into stepping stones towards financial growth! #FinancialMisstep #MoneyMistakes #LearnAndGrow

Reflecting on the past, it's natural to contemplate the financial decisions we've made. Are there any choices you would change today, armed with the knowledge you possess? Share your insights below and let's embrace the power of hindsight together! #FinancialDecisions #LearningFromMistakes #GrowingWiser

We all have those moments where we wish we could hit rewind on our financial choices. Have you ever made any notable money blunders that you wish you could take back? What would you do differently now? Share your stories below and let's support each other on the path to financial wisdom! #MoneyBlunders #Regrets #LearnAndGrow

If you could turn back time, what one financial decision would you change? Share your thoughts below and let's learn from each other's experiences! #FinancialHindsight #MoneyMistakes #TimeTravelWishlist

We've all made our fair share of financial decisions, but which one stands out as the most costly? Share your experiences below and let's navigate the lessons together! #MoneyMistakes #FinancialWisdom #LearnFromMistakes

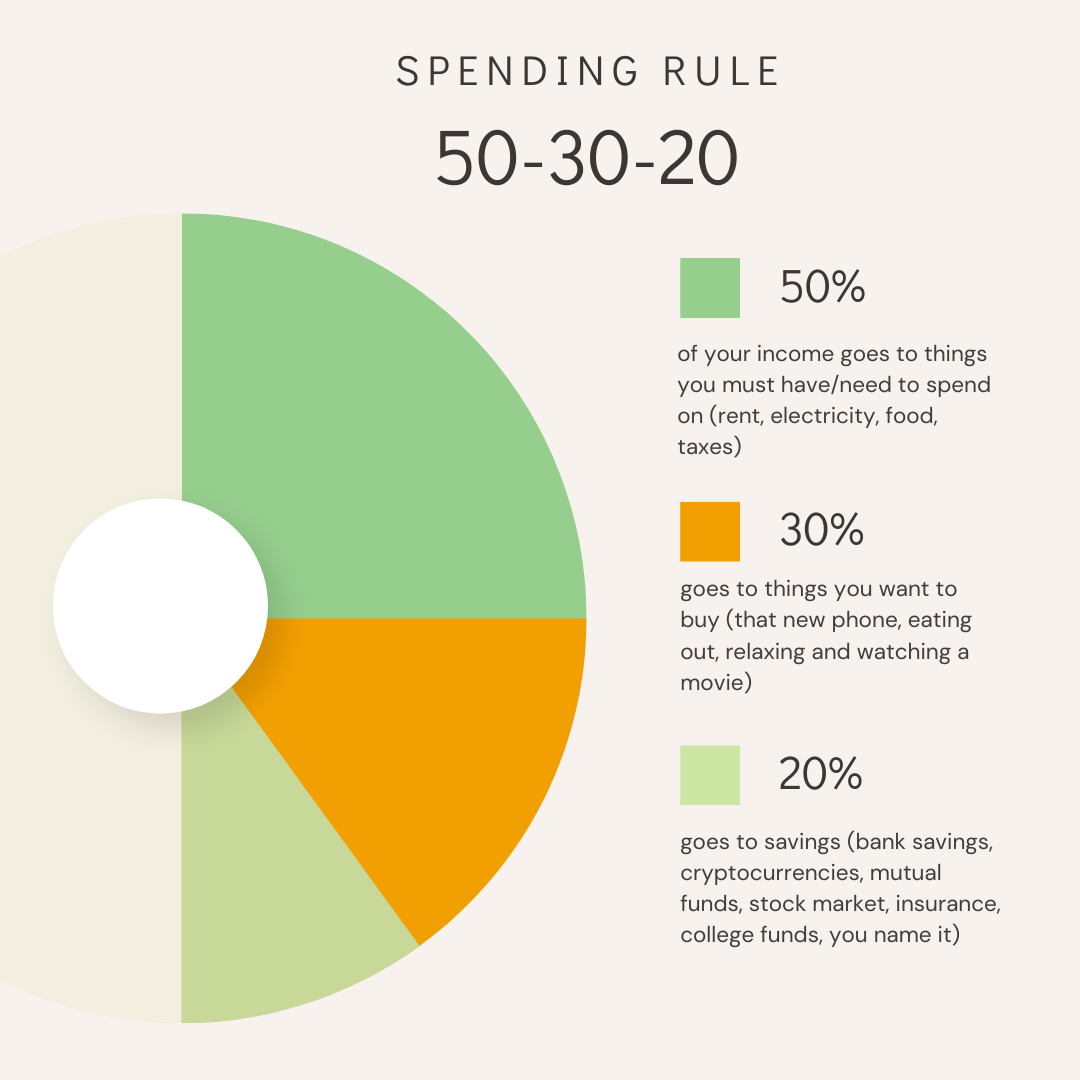

Mastering the art of financial balance with the 50-30-20 rule: 50% for needs, 30% for wants, and 20% for savings. Investing in a prosperous future while enjoying the present. #FinancialBalance #SmartSpending #SecureSavings

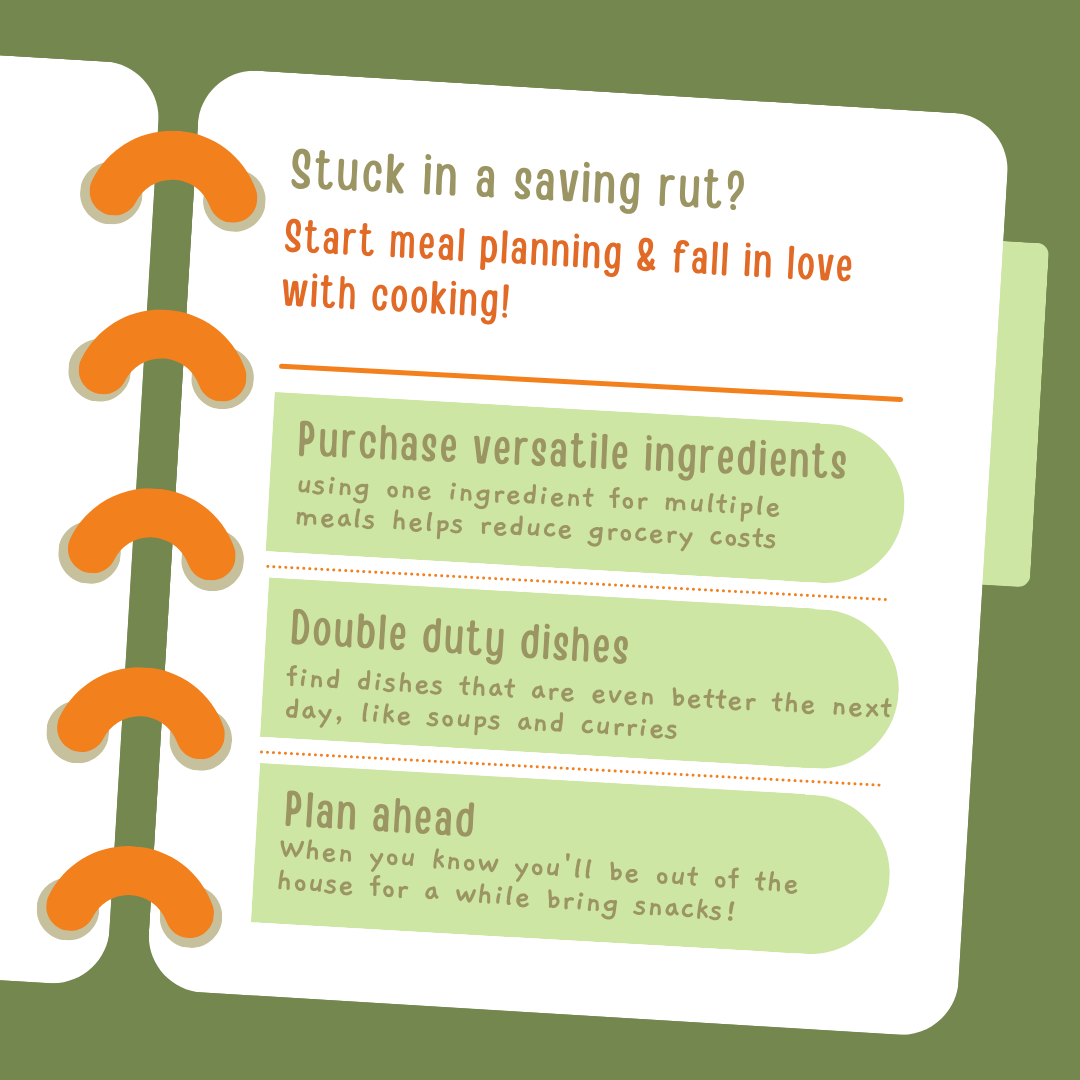

One thing every human has in common is that we need food! $15 daily lunches and $30 quick dinners out add up to thousands of dollars a year. Cutting back on those meals out and instead opting for cooking at home, you'll notice a difference in your bank account and your wellbeing! Plus you can turn it into a fun new hobby! #smartspending #mealprep #finaciti

We've all seen those posts about how your weekly starbucks latte could add up to a down payment on a house, right? And sure, the little things do add up, but focusing on removing large expenses that we don't need is so much more efficient than trying to cut out 10 tiny things. Do you go to a luxury gym for $200 a month that could be replaced with a $25 dollar membership somewhere else? Think about things like this when cutting back on your expenses! #smartsaving #finaciti

Setting a budget and a plan for yourself is hard enough, but bringing friends and family who are in different financial situations than you makes it that much harder. It's okay to set boundaries for yourself and your spending habits. True friends will understand and support you!

How did you strike a balance between enjoying your youth and saving for the future? Did you have any regrets in this area? How do young adults and young professionals set themselves up for the future without sacrificing their current experiences? #finaciti #smartspending #smartsaving

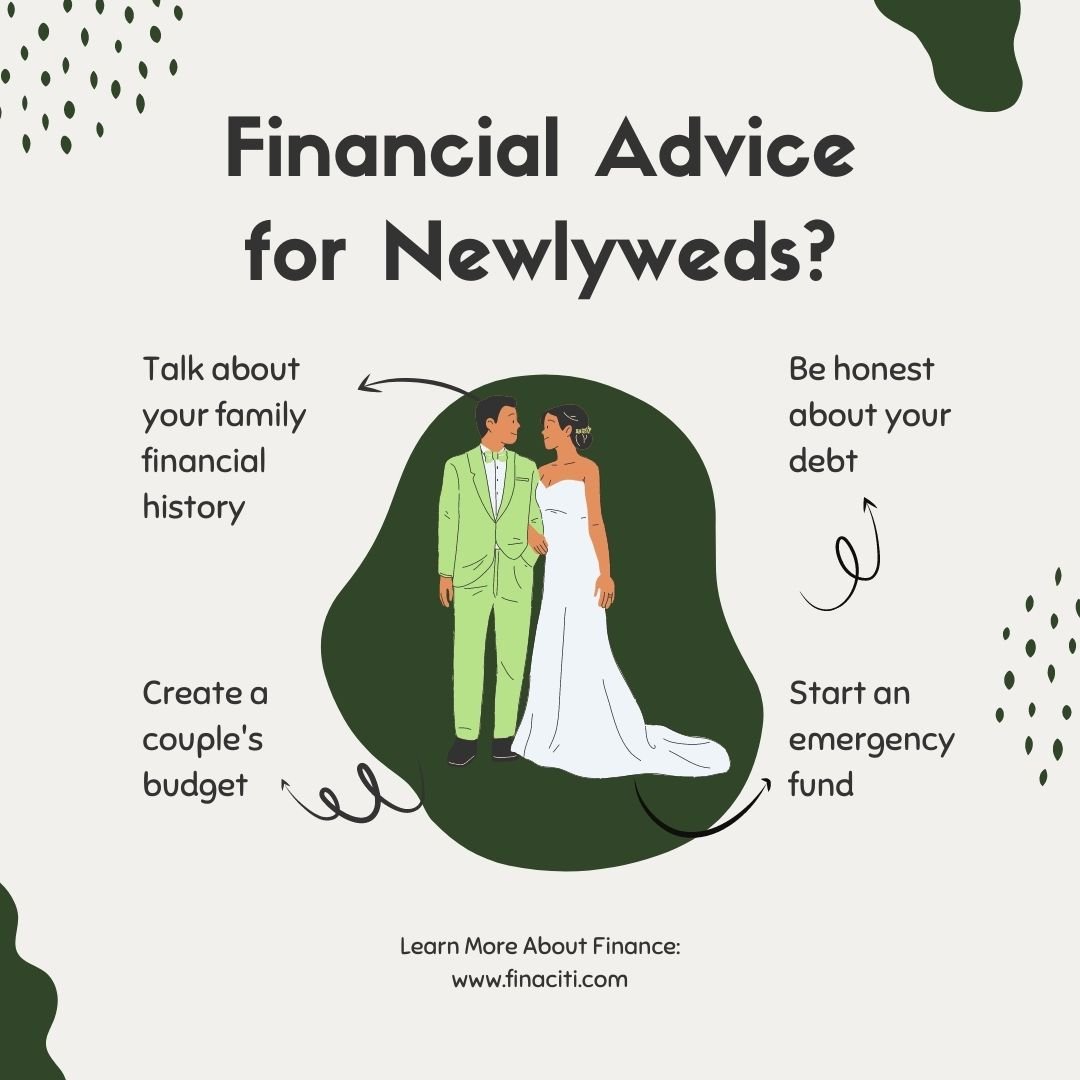

How did you manage your finances during your finances as newly weds? Do you have any tips for young adults starting their life together? If so, share below! #newlywed #finances #smartspending #finacity

Being a young adult in the crazy world that is today can be intimidating, especially when it comes to negotiating salaries and asking for raises at work. We are asking all professionals how they negotiated their compensation, vouched for themselves and stood firm on their worth. #knowyourworth #negotiation #finaciti

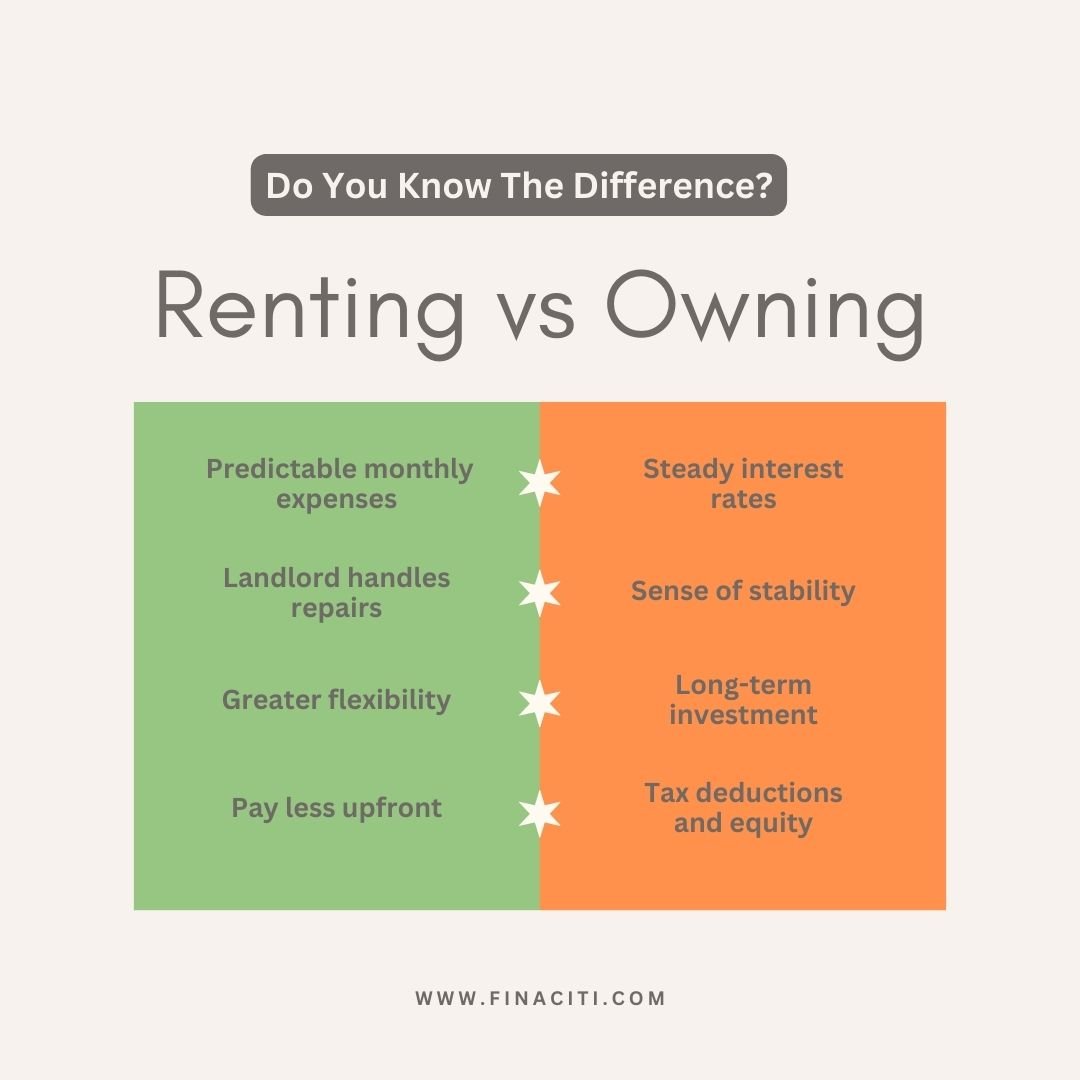

We want to ask our audience who is well versed in the home ownership and rental process what they think about choosing between renting and owning as a young adult. What were your experiences with homeownership or renting? Did you have any insights on the pros and cons of each option? Would you have done anything differently if you could turn back the time now? #rentvsown #smartspending #finaciti

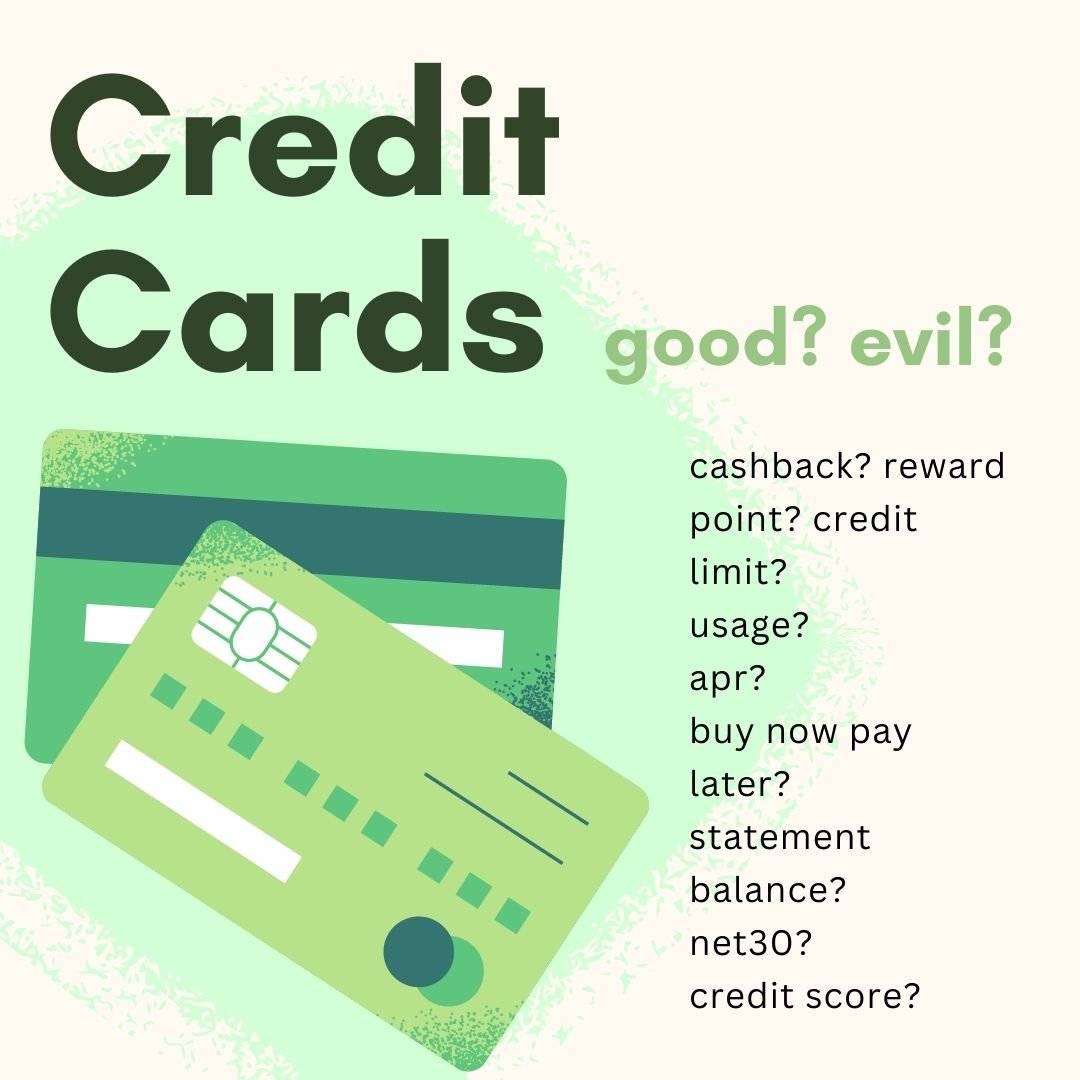

Most of us have a basic understanding of credit cards and how they work, but we're asking our more experienced audience if they have any credit card tips and tricks for those trying to build their credit. What's the difference between cash back and reward points? What is a credit limit and what percentage of it should customers be using? What does net30 mean? Should I just pay the minimum amount due, the statement balance, or the total balance? These are just some of the many questions many young adults have about credit cards. If you have any answers for them, drop a line in the comments! #creditcards #smartspending #finaciti

Aaah. Taxes. Everyone's favorite conversation ever, right? Yah, didn't think so. Many young adults feel like they were thrown into this financial world with zero education or knowledge on how to best manage their money, especially when it comes to taxes. For those that have been filing taxes for a bit we are asking how did you handle taxes and ensure you were making the most of deductions and credits available to you? What should young professionals be doing to ensure they aren't surprised with a tax bill at the end of the year? #taxseason #smartspending #finaciti

Arguably the most daunting and possibly most restricting financial indicator is a credit score. How did you work to increase your credit score? What's the best amount of credit cards to have? Do student loans hurt my score? What about buying a car? What if I can't get approved to rent an apartment? And the list goes on....What tips and tricks do you have to help our young audience increase their credit score? #finaciti #creditscore #smartspending

It can feel impossible to save money for big ticket items like cars and homes in today's financial system, especially for those just starting off in their careers and tackling student debt. How did you approach budgeting and saving for big-ticket purchases like a house or a car? Are there any strategies or tools you found particularly helpful? #finaciti #smartsaving